Video By: Rayees Ahmad and Rafiqa Bano | Article By: Alankrita Anand

Lanura and Manzigam were the first villages in Kashmir to go ‘cashless’, but they don’t even have proper roads, electricity and water supply, never-mind internet connection.

Demonetisation was perhaps the first shocker that the current government dropped after being voted to power. In the wake of the announcement, some rushed their money to banks and jewellers, others lined up outside of ATMs to withdraw whatever they could. Meanwhile, PM Modi’s pictures occupied the front page of most newspapers as part of a full-page Paytm advertisement. Paytm, a digital wallet company became the champion of a cashless economy, and other apps like BHIM (Bharat Interface for Money) and Airtel Money followed suit. And it is peculiar that although towns and cities are dotted with ATMs these days, albeit not all functional, villages were made the target for the cashless economy.

The first village to go cashless was Dhasai, a village in Maharashtra that went cashless on December 1, 2016, less than a month after demonetisation. According to reports, residents of Dhasai were swiping their brand new ATM cards while most of the country was lining up in front of ATMs. But this new system was short-lived, not only in Dhasai but in many other cashless villages across states.

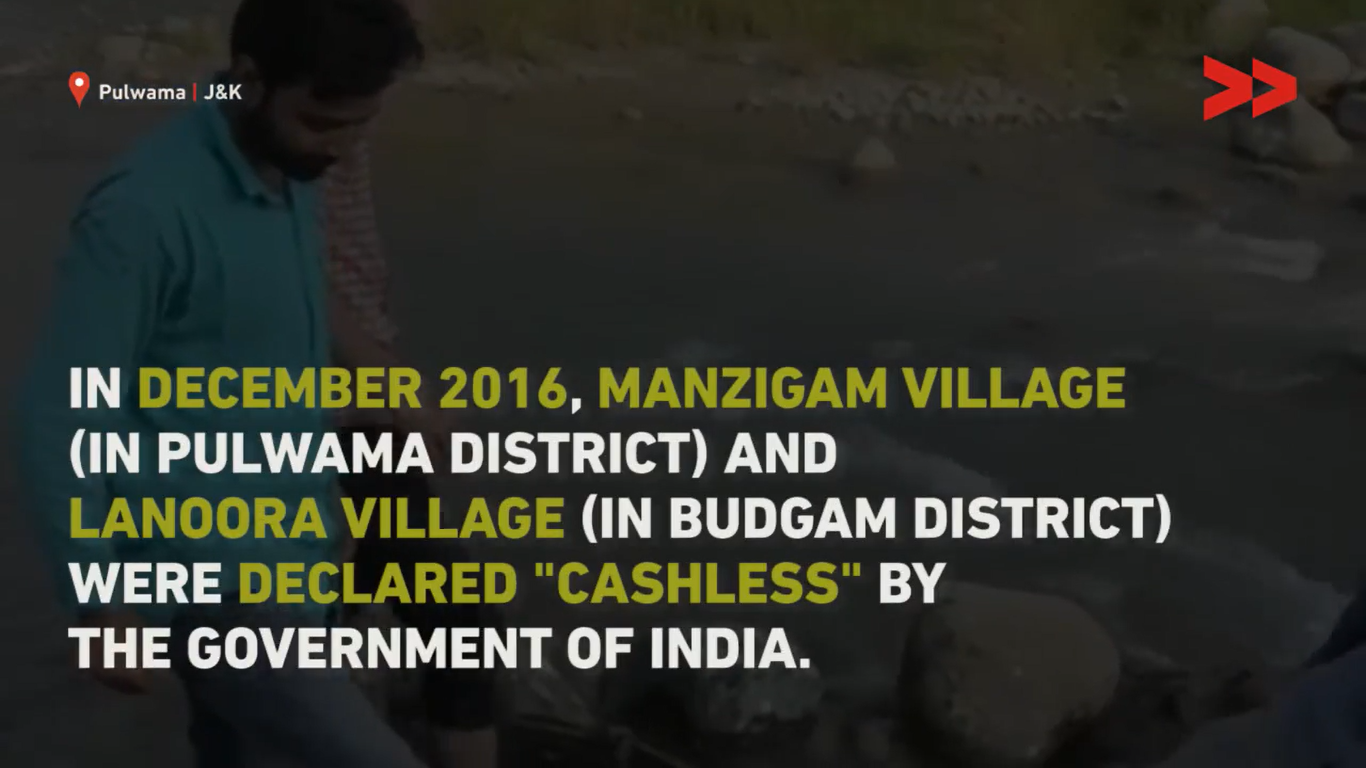

However, in Kashmir, in the villages of Lanura and Manzigam, the new system never took off, to begin with. Lanura has no bank or ATM and Manzigam has poor internet connectivity. How were these villages declared cashless, then? The answer is that according to the government, a village is declared cashless simply after an awareness workshop is held by the Common Services Centre e-Governance, a Digital India initiative.

Claims of cashless villages, rural electrification and the like look good on report cards and publicity material but most government schemes do not seem to be working beyond that. Part of the reason could be the government’s measurement criteria for various ‘achievements’. Just like an awareness programme is enough to declare a village cashless, a village is also considered electrified when it has minimal access to electricity, which is only 10 percent households and government buildings. Similarly, MNREGA (rural employment scheme) wages are considered paid when only the pay order has been given and not when the actual payment is made.

In Lanura, a village with a population of about 1000, around 150 people were trained and the target was to train at least one member from each household in the selected villages. But for someone like Nazir Ahmed, a worker with MNREGA, it makes no sense to sacrifice a day of work, which means a day’s money, to attend a training which is of no use to him.

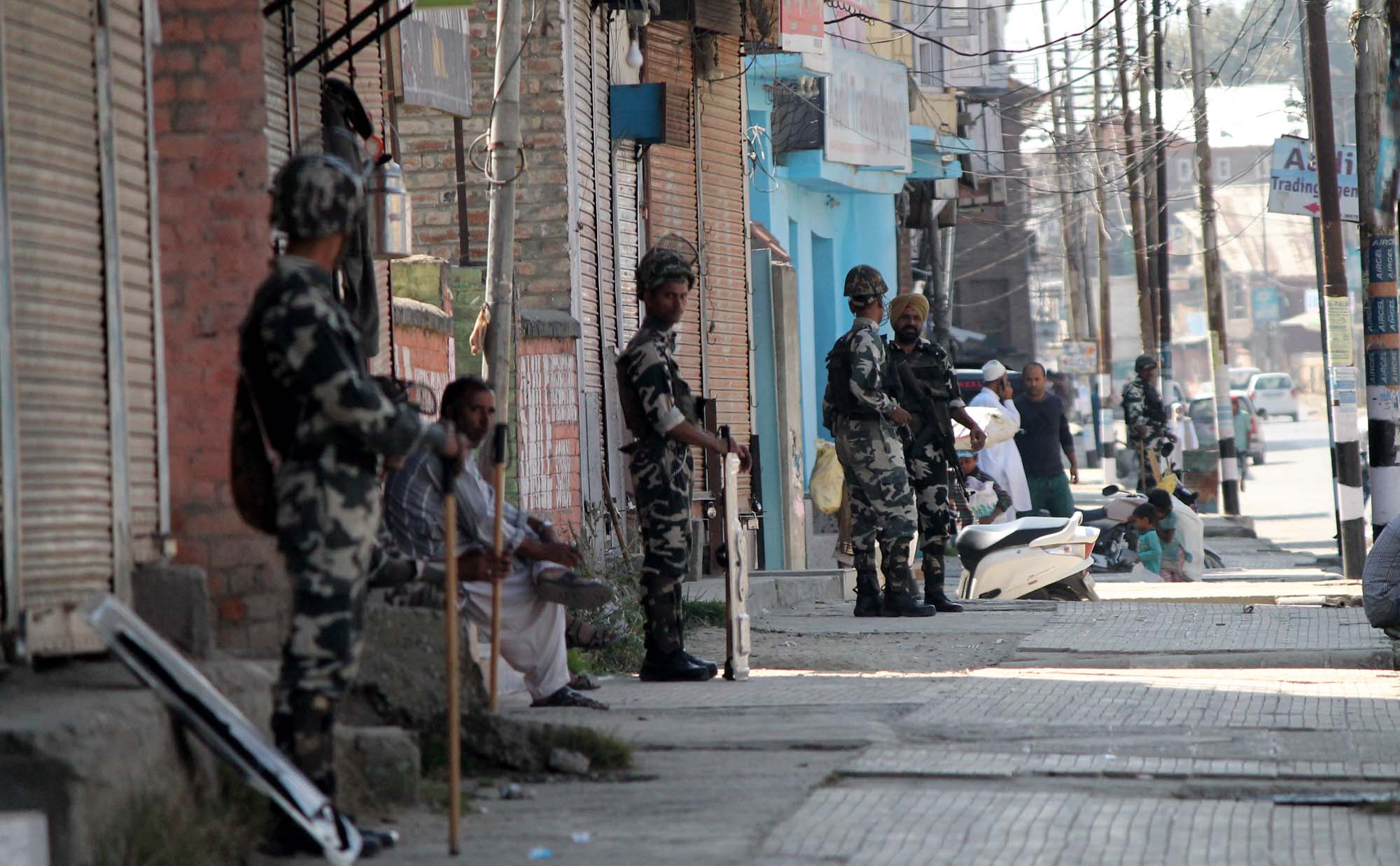

“We have no facilities here, the roads are bad, there’s a shortage of water and electricity supply”, says Ahmed, adding that they barely earn enough to save when Community Correspondent Rafiqa asks him if he uses an ATM.

Like the infamous “let them eat cake if they don’t have bread” situation, the residents of villages like Lanura and Manzigam are expected to carry out cashless transactions when they don’t even have basic facilities like roads and electricity.

Even the training that was conducted in these villages seems to have gaps. Abdul Gani, a shopkeeper in Manzigam, says that cashless transactions are only possible when there is internet. Interestingly, he does not own and knows nothing about a POS machine, the billing machine used for cashless transactions.

Reports also suggest that in Kashmir, residents are also concerned about the effect of frequent internet bans at the behest of the government. Moreover, even if there is efficient internet connection, apps like Paytm and BHIM, don’t necessarily promise smooth functioning and take on minimum liability for failed transactions.

Residents in villages like Lanura and Manzigam, in the meantime, feel like a cruel joke has been played on them.